Beginning with the Basic Concept of Investment in Mutual Funds

Futureincomes.site I hope you are still happy yes, At This Hour let's examine various perspectives on Investment. In-depth Information About Investment Beginning with the Basic Concept of Investment in Mutual Funds Immediately explore the information to the last point.

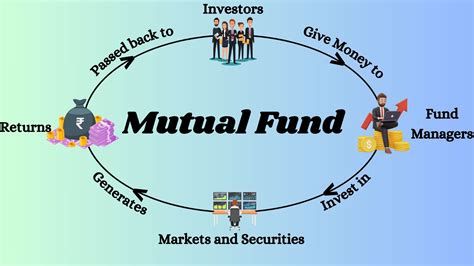

A wide range of people have started investing in mutual fund as an investment avenue with a growth objective. Mutual funds are those investment schemes which are established with the contributions of many investors putting their fractional portions together which then are managed by professional funds managers for income on their behalf.

The main characteristic of mutual funds are their diversification, as they may be made up of several varieties of investments including random stocks, bonds, gold, or currencies. This diversification provides a buffer so that no one investment fails to carry the weight of all the others.

In addition, mutual funds increase the transactions ability of the investors by allowing them the right to buy or sell their shares of mutual fund any time. Furthermore they create opportunities for qualified management and analysis of research, hence, suitable for any experienced or budding investors.

As a consequence of both growth potential over a long term and easy accessibility, mutual funds are likely to constitute a positive element in an investment portfolio.

Understanding The Investment Structure Of A Mutual Fund

In broad and naive terms, a mutual fund may be defined as hordes of capital pooled together by various and many people, which organizations intend to use for investing in shares, bonds and other collateral classes.

Mutual funds are controlled by professionals, who are known as fund managers, for investment trusts. For example, there are several benefits to be derived from investment in a mutual fund such as. First and foremost, it helps those that are not able to invest sufficient sums of money to invest into a pooled investment to have a broad portfolio.

Because they cooperate with investors to combine their funds, they also reap the cast of the merger, which is beneficial since it lowers risks while not necessarily compromising on the returns on investment. Furthermore, the mutual fund is managed by specialists that possess the relevant education and work experience in the field of investment.

These funds managers have really put in a lot of homework on the subjects they are managing, their investment principles and a great deal of common sense which they put to use towards the investors’ benefit. Out of the various advantages of mutual funds, liquidity has to be one of the most appealing ones.

In contrast, for example, to real estate or private equity investments where there may be a sale of the investment at the request of the general partners, mutual fund investments have a generally very high liquidity and can easily be traded on the stock exchange. That people can withdraw their shares whenever they wish to do so gives investors a greater degree of convenience than is required.

At this moment, however, it is important to point out that not everything is risk-free when it comes to mutual funds. This is so because the amount which the fund bears is referred to the trees which these securities are representing. Of course, past performance does not guarantee future performance and the likelihood is that in most times the investors will not be able to recoup the entire amount invested.

Although there are other considerations that investors can be involved with strategies, it is recommended that the investors pay attention to the actual document, which defines the investment objectives, the relevant risk and the expenses that the fund will attract. Participation in the mutual funds market thus requires the individual investor in particular to consider his or her personal aspirations, willingness to accept risks and the intended duration of the investment.

To sum up, investors who seek to enrich the portfolio and at the same time take advantage of a professionally managed fund should consider investment into mutual funds and portfolio investment schemes. But with such advantages of mutual funds, there are also a lot of risks and thus, a lot of caution and proper research is needed before committing any funds.

As a result, investors will be in a position to make informed choices and perhaps benefit from the long-term investment potential and income generation opportunities associated with mutual funds.

Mutual Funds – Which Are the Best Investment Options?

It is worth it to invest in mutual funds since the investors can benefit in several ways but should be keen to focus on wealth building first. One of the main reasons is the concept of diversification, considering that mutual funds aggregate resources from different investors to invest in various securities such as stocks, bonds, and others.

This diversification helps in reducing the risks and shields the individual’s investment portfolio from excessive volatility. They are also professionally managed by fund managers whose job, in the course of deep analysis answering the make sound decisions , is to invest.

Such experience and knowledge means that the returns on such managed strategies could be greater than picking stocks on an individual basis. Also, mutual funds are easy to buy or sell since they come with liquidity so that when someone invest in them he can sell his shares or buy at will. This diversity allows investors to pin point where to invest whether equity or debt fund from a range of funds making mutual funds a significant investment tool for many of the wealth managers.

Types of Mutual Funds: A Comprehensive Overview

There are many types of mutual fund which have been classified on the basis of their features and benefits. Equity funds for instance, fund investments in shares, which are expected to appreciate in value. Investors having a notion of funding the government bonds or corporate bonds out invests in bond funds, which over some duration brings in more returns.

Balanced funds also contain both stocks and bonds thus enabling an investor to have a broader sphere for assets. Besides, index funds seek to mimic the performance of specific indexes for example, the S&P 500 index fund. Conversely, money market funds are those funds that invest in short-term instruments with lowest risk for instance, Treasury bills.

These types of mutual funds are essential for investors who wish to create a well-structured and profitable investment portfolio.

Examining the Nature and Features of Equity Mutual Funds

Examining the Nature and Features of Equity Mutual FundsInvesting in stock markets is always risky and can be likened to an art that a novice will find hard to master. Nonetheless, equity mutual funds are one way of getting into this intricate field and investment sways the risk to more diversified levels.

These are funds that are targeted at stock markets and use the experts already in the industry with good managerial experience to run them. Therefore, equity funds appeals to many investors since it allows them to invest in different companies operating in different industries thus enabling one to spread risks and increases chances of better returns.

Pooling resources together by different investors enables these funds to cover large stock markets to benefits from lower unit costs. Besides, equity mutual funds allow investors to invest in different markets, either local or foreign ones.

This opens the door for better risk dispersion and access to wider investment opportunities. Like other types of investments, developing an investment strategy and picking a suitable equity mutual fund amongst the many to suit the investor’s objectives and tolerance for risk is very important.

With equity mutual funds, investors, stock markets invest through, are professionals in management and thereby diversified markets.

Exploring Social Security Benefits

Duty of Fund Law to RetireesEmploying Social Security benefits is essential for the United States population. Within Fiscal year 2023, beneficiaries had the option to cash out a meager amount of $334 billion approximating about 6.38% of the outstanding federal bonds issued. Social Security is not only limited to people who retire, it goes on until the beneficiaries remain alive and is the Primary focus for disbursements. The Duty of Fund Law towards retiree is vital. First of all, an Employee within a given firm does this through his perspective retirement plans. Once earned, these contributions which are tucked carefully under Employee Provident Fund act as seed capital for the entire family.

In general, bond mutual funds can be a sound investment option if you are looking for both safety and returns such that your investment is worthwhile.

The Unmasking of Money Market Mutual Funds: Strategies for Short-Term Funds

Money market mutual funds are ideal for making short-term investments. Investors are likely to earn higher returns than when they were using a normal savings account, but there is still relatively low risk.

These funds are made up of short-term, high-grade debt obligations and allow investors to have easy access to their funds. For all other types of mutual funds including equity ones, money market funds usually do not aim to maintain the net asset value, but rather restrict it to one dollar per share.

As a liquid and safe investment, money market mutual funds are licensed and regulated by the SEC. Due to their focused aim on encouraging stability and liquidity, money market mutual funds stand out as a good vehicle for investments, particularly for those who are looking for short time frame investment options.

The Importance of Index Funds in Mutual Fund Investing

Index Funds hold a strong importance in the process of mutual fund investing. The investment of these funds is done to meet a particular objective that is to replicate a specific set of the market index for instance S&P 500. High expense ratios can be one of the disadvantages offered by investment funds, however index funds are an ideal alternative since one of the advantages offered by them is the low expense ratio.

Moreover, since index funds allow investors to invest in a fund that invests in a large number of securities in the index, there is diversification of expensive cost through individual stock picking risk.

In addition, index funds tend to be low on turnover and this may lower a tax burden on the investors. There is low maintenance for the index funds because they are easy to manage, they are low in terms of costs and they are diverse which are the main reasons why index funds are usually a needle in the haystack of any other mutual fund’s investment strategy.

Sector Funds: Particular Industries

They are often referred to as a mutual fund with sectoral investments and they concentrate on one industry for instance tech, health care, or energy. The investments in these funds will allow investors to focus in an area that they expect will perform better than most of the economy.

Such sectoral funds allow individuals to benefit from the growth of a given industry but still spread their risks by having more than one sectoral investment. But sectoral funds can also be risky since they are more volatile than diversified funds.

However, investors contemplating sector funds must investigate and comprehend the risks of a particular industry thoroughly. In general, the development of sector funds appears to serve as a beneficial tool for investors by collecting a focused exposure towards the promising sectors of the economy.

Balanced Funds: A Middle Ground between Equities and Money Market Instruments

Balanced funds, referred to as hybrid funds, aim to provide a balance between equities and debt. The investment objective of such funds is to provide investors with growth combined with income by investment in both asset classes.

Typically, the equity component of the funds is expected to give some room to capital appreciation whereas the debt part is intended for stability and income generation. The purpose behind this strategy is to lower overall exposure to risk and at the same time, limits volatility of investment.

Balanced funds are popular with many investors who desire moderate risk experiences while seeking the growth and income components in their portfolios. With the intention of the balanced and the bond funds, it is aimed to be a complete investment package for many investors.

Growth Funds: Finding Opportunities Through the Hype Cycle

Growth funds are that way of the funds which try and take advantage of long range prospects in the growth of the market. Growth funds invest in seeking growth oriented companies which makes them long-term investors who can create wealth out of the corporations that is established.

Growth funds reap profitable returns by investing in companies expected to grow. These funds are well-suited for investors looking to tap into high-growth sectors of the economy, like, technology, healthcare, or consumer goods with an extensive collection of high-performance stocks.

This also exposes the investors to growth in such innovative and potential companies. For patient investors who know they are investing for the long term, growth funds are an excellent way to take advantage of the magic of compound interest while benefitting from the growth of the best businesses.

Value Funds: Investments In Stocks That Are Priced Below Their Actual Worth

Value Funds: Investments In Stocks That Are Priced Below Their Actual WorthValue funds are types of investment funds that are interested in finding stocks that are relatively cheap in the market. These funds are intended to identify stocks that can be purchased at a price less than their true worth.

The rationale for the value funds strategy is that there are times that stocks are quoted too high, or too low, for valid reasons, which is seldom the case. Value fund managers conduct substantial research before making stock selections in anticipation of later growth.

Value funds usually rely on the following methods:

- Fundamental Analysis: The managers of value funds evaluate the profit, cash flow, and balance sheets of a business to decide what its worth is. Such people look for stocks which have a market price less than their true worth.

- Inverted Investing: Value fund managers are known to be inverse investors, making their move in stocks which are worn out from the market or are going through rough and harsh times. Yet, they feel that these stocks have chances of bouncing back and in the long term hence making good returns as the stock increases in value.

- Perspective: One characteristic that distinguishes value funds from other types is the long- term investment horizons that they have. They buy and hold the off-valued stocks until the true picture of them is seen in a span of about three years. This calm soothes the nerves of the investors such realms enabling them earn the upside of the ignoble off-valued stocks.

- Diversification: Value funds are meant to be well diversified and thus various the different stock holdings across various sectors and industries.

This strategy of diversification assists in the reduction of risk and controls the overall impact of the work of a single stock on the total fund. However, it is worth emphasizing that there are risks of investing in value funds, for instance, there is no certainty that the true value of the stocks within the fund will be appreciated by the market.

Furthermore, the characteristics of value funds can be determinant in the type of the market as well as the level of the marketolien of funds. Summing up, it can be said that value funds attempt to find such stocks which are priced lower than their true market value and give investors chances to enjoy their growth prospects.

Value fund as a category of funds tries to earn attractive returns for their investors by employing such strategies as fundamental analysis, contrarian investing and focusing on long term horizons in the strategies of the value fund managers.

Dividend Funds: Investing in Dividend-Cashing Stocks with High Returns

Most people today think about dividend funds as having a relatively steady portfolio that can help generate income with less risk. These particular funds are usually abused on a dividend bos, particularly tracks. These are funds that follow stocks that pay dividends relatively easily.

Investing in dividend stocks allows investors to receive cash payments on a regular basis together with capital appreciation. One benefit that can also be highlighted is the provision of regular stream of income through these funds.

When investment performances are strong, value growth brings out even the dividends annual payments to improve. Hence it attracts interest within invested people since that is the aim of investing through dividend funds.

The dividends not only provide immediate cash flow, but also can be reinvested with the aim of enhancing returns. When these shares are purchased in the name of an investor, almost always the whole price does not come out with the shares, so the return is usually substantial in such situations.

However, there are risks with the idea of dividend funds too. Price movements in performance of the fund share the same within the performance of shares of the fund. If a company experiences troubles within its operations and cannot perform well, or simply cut its dividends, that can also affect the fund returns.

In conclusion, those who seek regular income and growth of capital may find dividend funds to be appealing. It has been shown that by investing in high-yield dividend stocks, dividend holders can receive both cash dividends and the possibility of capital gains.

That said, it makes sense to do some homework to choose dividend funds that are suitable for the particular investor’s requirement and risk level.

International Mutual Funds: An Introduction

Of course, here is the restored/revised paragraph:International mutual funds are one of the useful tools for broadening your investment portfolio. There are these funds which enable the investors to invest in different foreign markets and industries, thereby lowering their risk and potential losses.

In this times as the world economy is becoming more integrated, these international mutual funds can also be used to benefit from both growing and developed economies. Points out the need to know both the specific risks and opportunities of such investment and also appreciate how exchange rates may affect returns.

Investing with an international perspective by using these international mutual funds may be a good tactic in pursuing long term growth of wealth.

An Insight into Expense Ratios in Mutual Funds

Investors interested in executing appropriate strategies regarding investments in such funds need to focus on expense ratios. As such, expense ratios reflect the fraction of mutual funds od a particular fund that is set aside for the purposes of expenses handling.

In such items may include management costs, administrative expenses, and other costs related to the operation of the fund.Investors are encouraged to pay attention to such ratios as they encompass a direct effect on the income a particular investor is likely to realize from the invested funds.

Expense ratios that are low or on the lower side are generally preferred by investors as most of the profits of the fund will be paid back to the investors. Funds with high expense ratios on the contrary, may cut back on the potential returns and the overall investment performance.

Before investing in such mutual funds, it is important to keep in mind that the weak points of many such investment vehicles, in addition to diversification among different classes, are their kinda burden which are expense ratios that can be quite significantly different from each other. It is advised to examine expenses ratio in context of other funds in the range as well.

Moreover, it is important that investors also take into account other related factors like the investment objective of the fund, its past performance records, and fund manager expertise. To summarize, if one understands the expense ratios, then that is good news for investors in general and mutual fund investors in specific in order to maximize profits.

When funds level an expense ratio with discretion, as with other significant considerations, then investors can intelligently make selections which are likely to drive them closer to expected outcomes.

That is the discussion about beginning with the basic concept of investment in mutual funds that I have explained in investment Don't forget to continue learning and developing yourself always innovate in learning and maintain cognitive health. Don't hesitate to share this with your friends. don't forget to check other interesting articles. Thank you.

Type above and press Enter to search.